The second day of the WAIPA Global Leadership & Innovation in Investment Promotion Masterclass collaboration with the World Free Zones Organization (World FZO) delivered another series of engaging and strategically relevant sessions. Hosted in Geneva, the program brought together global investment professionals, IPA leaders, and development partners to focus on long-term investor relationships, inclusive growth, and smart sector targeting.

The day culminated in a landmark visit to the International Labour Organization (ILO) Headquarters, where participants explored the critical links between investment, decent work, and sustainable economic development.

Morning Focus: Elevating Aftercare & Advocacy

The day opened with a focused discussion on aftercare and post-investment services, a critical area often overlooked in investment promotion strategy. WAIPA’s Deputy Executive Director Dushyant Thakor outlined a tiered approach to aftercare (Platinum–Gold–Silver) and stressed the importance of strategic segmentation, dedicated teams, and policy responsiveness.

Key takeaways included:

-

The need for long-term investor engagement beyond attraction

-

Importance of feedback loops between investors and policymakers

-

Use of structured aftercare programs, modeled on successful examples like KOTRA

-

WAIPA’s IPA Toolbox, offering templates, engagement models, and aftercare design tools

Delegates shared challenges and best practices from their own countries, highlighting the balance between personalization and scalability, especially in resource-constrained environments.

“Aftercare isn’t just support, it’s a strategy. It’s about understanding what investors need to grow and building policy responses around that.”

Exploring the Longevity Economy: A New Frontier for Investment

In a thought-provoking virtual session, Mr. Nitin Jaiswal, Founder of AgeTech Leadership Labs and WAIPA Business Advisory Board member, urged participants to see aging populations as economic assets, not just demographic challenges.

Mr. Jaiswal introduced frameworks like the Longevity Economy Square, calling for alignment between life, health, wealth, and wellness. He also advocated for cross-sector engagement—connecting IPAs with ministries, investors, communities, and the private sector to build investable longevity ecosystems.

Key points:

-

Infrastructure readiness for older adults: physical, digital, and social

-

AgeTech investment potential in healthcare, fintech, mobility, and beyond

-

Workforce inclusion for older populations: re-skilling, job redesign, and policy innovation

The longevity economy, Mr. Jaiswal emphasized, is scalable, sustainable, and investable—but only if recognized early and supported with forward-looking policy.

Highlight of the Day: Visit to ILO Headquarters

The delegation’s visit to the ILO Headquarters in Geneva was a standout moment of the Day 2. Discussions led by Rie Vejs-Kjeldgaard and Githa Roelans focused on how IPAs SEZs can drive job creation, skills development, and social stability through responsible investment.

Themes discussed:

-

SEZs as engines for decent jobs and competitiveness

-

The importance of transparent labor practices to attract ESG-conscious investors

-

Linking incentives to job creation, training, and skills transfer

-

How “do no harm” principles and human rights due diligence are becoming standard in global value chains

Afternoon Insights: Tech and Health-Focused Investment Strategies

The day concluded with two high-level sessions focused on strategic sector attraction:

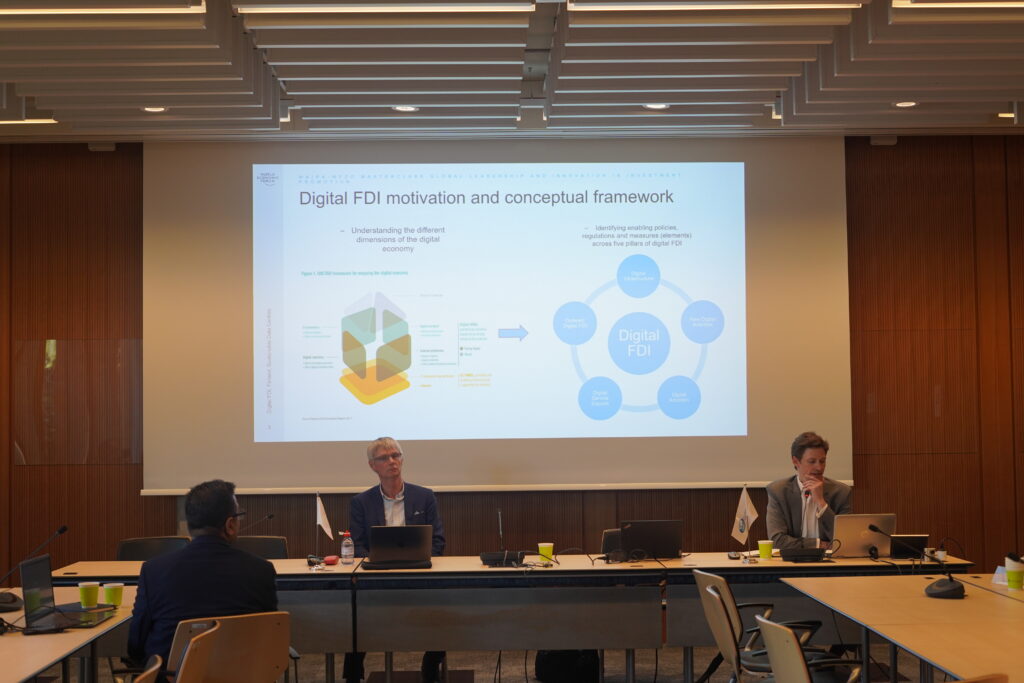

1. Attracting Digital Investment

Dr. Matthew Stephenson Head, Investment and Services at World Economic Forum and Mr. Antti Aumo, head of Invest in Finland at Business Finland outlined the key enablers for attracting data-driven and hyperscale investments:

-

Clean energy and grid reliability

-

Predictable and transparent data regulation

-

Skilled digital workforce

-

Strong ICT infrastructure and connectivity

Finland’s zero-subsidy model, which attracted $10B+ in data center investment, served as a compelling case study. Its success hinged on infrastructure strength, not incentives.

2. Medical Device FDI

In a targeted session, Dr. Trevor Gunn, Vice President of International Relations at Medtronic, shared how IPAs can better support investment in the medical device sector:

-

Facilitation through regulatory navigation

-

Accelerated market entry pathways

-

Innovation support and talent development

This session emphasized how IPAs can become critical partners, not just gatekeepers by creating pathways for innovation-led, health-focused investment.

Conclusion: Strategic Engagement is the Way Forward

Day 2 reinforced WAIPA’s mission to equip IPAs with the tools, insight, and partnerships needed to navigate the future of investment promotion. From designing smarter aftercare systems to understanding the untapped potential of aging economies, and from job-creating FDI to enabling cutting-edge tech and medical investment—the day offered a powerful blend of vision and practical strategy.

As the week continues, one theme is emerging:

Long-term, inclusive, and ecosystem-driven approaches will define the future of investment promotion.